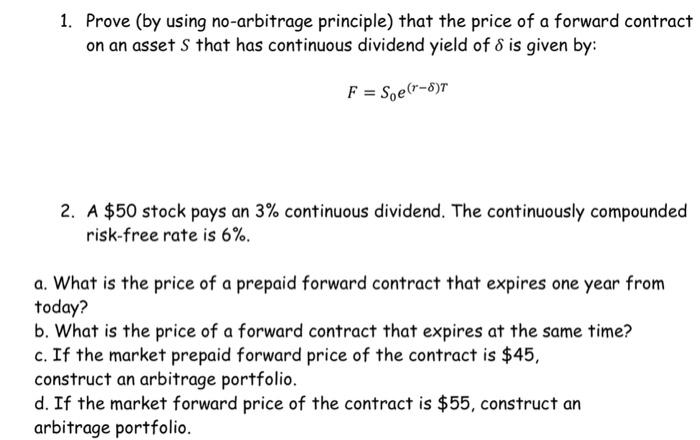

dividend yields: Higher than FD returns: 5 stocks with 7% to 13% dividend yields and continuous dividend payments for 12 years - The Economic Times

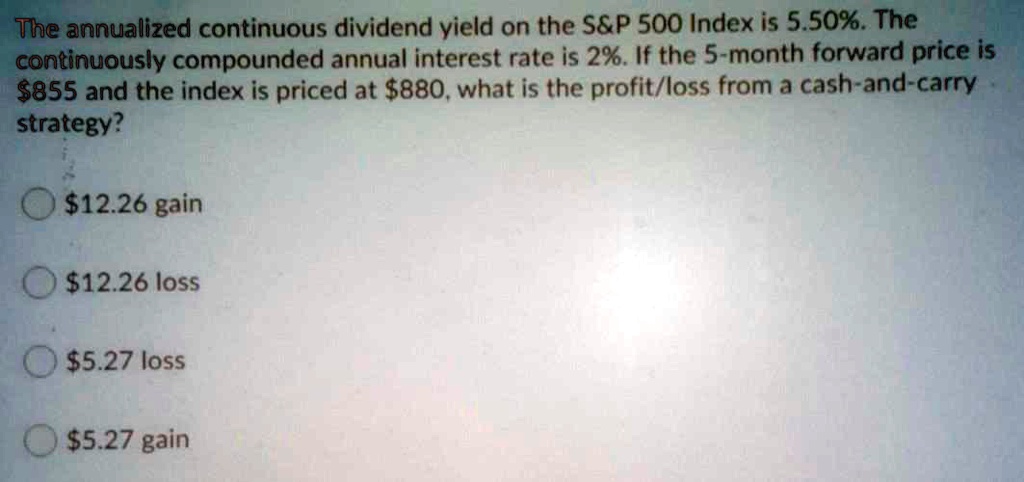

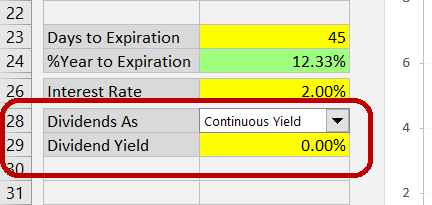

SOLVED: The annualized continuous dividend yield on the S P 500 Index is 5.50%.The continuously compounded annual interest rate is 2%.If the 5-month forward price is $855 and the index is priced

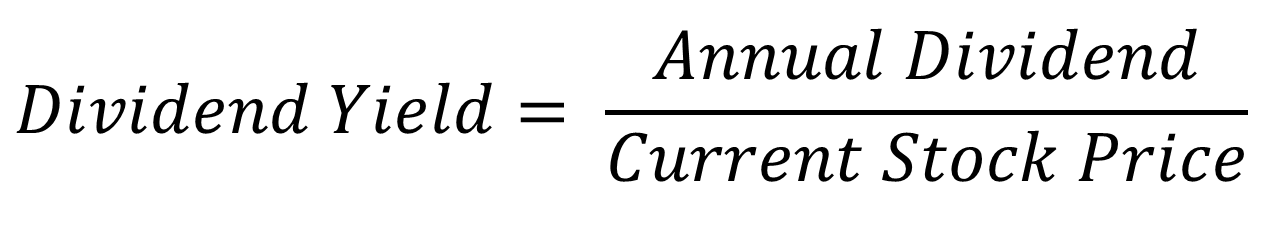

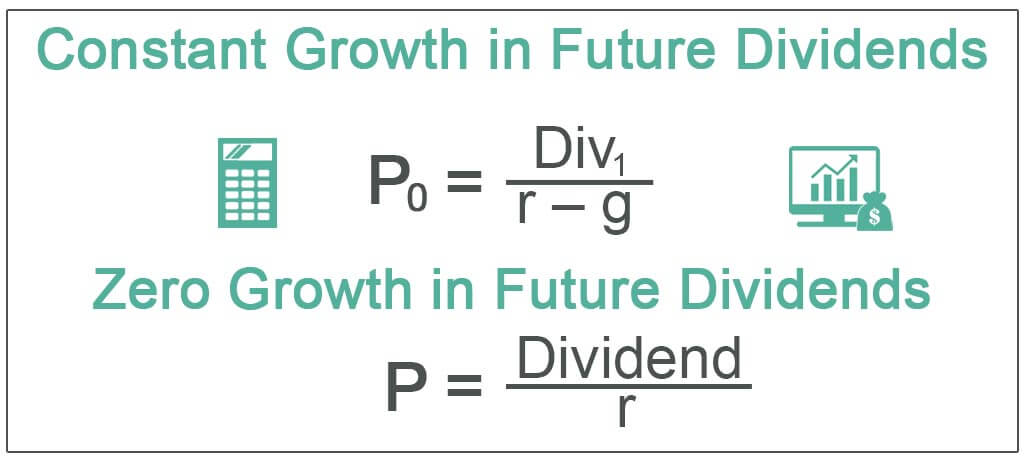

If D1 = $3.00, g (which is constant) = 5%, and P0 = $35, what is the stock's expected dividend yield for the coming year? | Homework.Study.com

4 stocks with 5 % to 8.87% dividend yields and continuous dividend payments for 7 years - The Economic Times

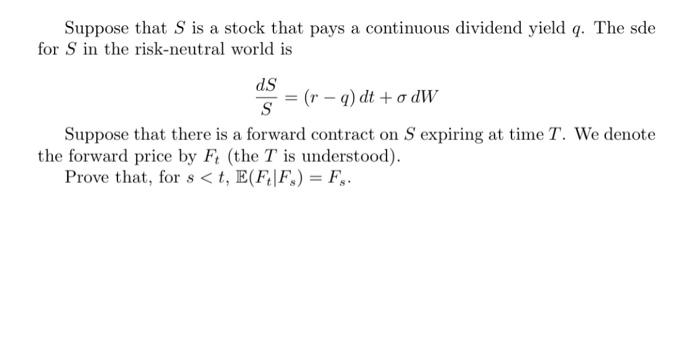

Hull OFOD 11e Solutions Ch 17 - CHAPTER 17 Options on Stock Indices and Currencies Short Concept - Studocu

:max_bytes(150000):strip_icc()/dotdash_Final_Forward_Dividend_Yield_2020-01-167ed1a41c1c48599fa394f4f4faf342.jpg)

:max_bytes(150000):strip_icc()/Dividendyield-7b535251438e49e082af72aa59706e18.jpg)